The early American presidents had a very different view of money than most people today. We can still see their faces printed on the front of our bills, but their distant words of wisdom go mostly unheard.

They understood that having centralized control of an entire nations money supply is something that would not be in the best interest of the majority of people.

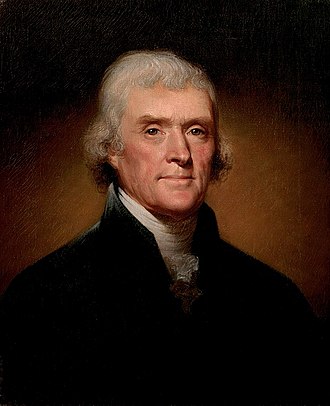

Thomas Jefferson once said,

If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered…. I believe that banking institutions are more dangerous to our liberties than standing armies…. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.

And he was right. That reality is already here.

- 40 million Americans are living on food stamps

- Millions more are homeless living in tents

- And 80% of Americans are living paycheck to paycheck (in other words, broke).

Thomas Jefferson also said,

The modern theory of the perpetuation of debt has drenched the earth with blood and crushed its inhabitants under burdens ever accumulating.

And how true these words are. The Federal Reserve bank does nothing more than continuously debase the currency by printing more and more dollars, and raising the debt ceiling to greater highs. Those who are the most impacted by this are the poor. Without fair and equal access to financial literacy, the only thing that most people will do is consume liabilities, and continue to get crushed under the ever increasing burden of debt.

Since private central banks control the creation of money, and smaller banks distribute loans and credit, bankers own two-thirds of the entire worlds money supply. The divide between those who are rich and poor is as wide as the grand canyon.

In total, the United States is now over $30 trillion dollars in debt, inflation keeps rising, and its getting worse every day. But who can pay this debt back? The truth is, this is a debt that can never be repaid. It’s beyond that now, it’s growing at an exponential rate. But the tax laws still obligates every single working individual to pay federal taxes regardless.

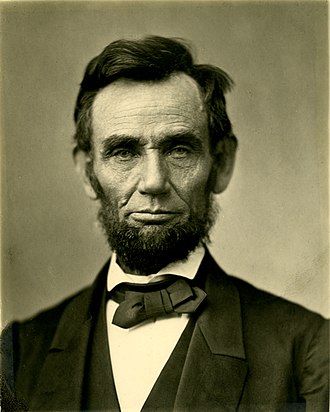

Abraham Lincoln once said,

The government should create, issue, and circulate all the currency and credit needed to satisfy the spending power of the government and the buying power of consumers. The privilege of creating and issuing money is not only the supreme prerogative of government, but it is the government’s greatest creative opportunity. The financing of all public enterprise, and the conduct of the treasury will become matters of practical administration. Money will cease to be master and will then become servant of humanity.

He believed that only the government (and not any central bank) should have control over the distribution of wealth.

I think many would argue against this view, but the core of his argument is the same; he knew that private centralized banking would lead to huge divides between the rich and the poor and humanity would ultimately suffer as a result.

During his presidency, Abe Lincoln also attempted to solve this problem by issuing greenbacks, a (now defunct) paper currency that was created by the United States government and not any bank. But his idea never became a reality because he took a bullet in the back for trying to give African-Americans equal rights.

Today, the money-creation process is solely the privilege of the Federal Reserve System. Most people don’t realize that they are not a government agency — they are a private organization that was created in secrecy, and history shows that they covertly stole the money-creating power from the American people.

The recent move towards decentralized digital currencies like Bitcoin, is however, a very small push back, it’s a stepping stone towards giving this power back to the people by creating value in virtual currencies that operate in a peer-to-peer fashion without the need for any kind of middlemen. But who’s to say if this will even happen. It most likely seems that the ruling authorities will destroy it before they allow money to ever become privately owned by citizens. But what do you think?

Do you agree with the dead presidents? What do you think about the Federal Reserve bank? And do you think a new kind of peoples money, (like Bitcoin) would help? Leave your thoughts in the comments below.

Additional Resources

- Presidents and Founding Fathers on Money

- Financial Advice from America’s Founding Fathers

- Money Lessons of America’s Founding Fathers

Disclaimer: This article was written for educational and entertainment purposes only. This is NOT financial advice. Always do your own research and please consult with a licensed attorney before making any serious investment. We are not responsible for any investment decisions that you choose to make.