Upon reading the title of this article, the majority of you readers will probably already have some kind of preconceived notion in your mind. Thinking about how to buy gold, you probably have some level of skepticism.

Some of you will think: “Only rich people buy gold.“ or “I can’t afford to buy gold.“

But that is not true, because somehow we always seem to find the money to spend on things that we perceive brings value to our lives; such as eating out, or buying the latest iPhone or new clothes.

You can buy penny-sized coins of pure 24-karat gold for less than the price of a smartphone.

Others might think: “I have no need for gold.“

Do you have a need for money? It might surprise you to learn that the United States Dollar (USD) was originally created as simply an IOU for gold. Gold was/is real money. Whereas the US dollar is simply a currency.

Yes, paper currency only has value because the government says its legal tender. Merchants in America are obligated to accept nothing but USD (in paper or digital form) but its not real money. It’s an instrument that the government can use to control the currency and manipulate interest rates.

Still, others may think: “Gold is not a good investment.“

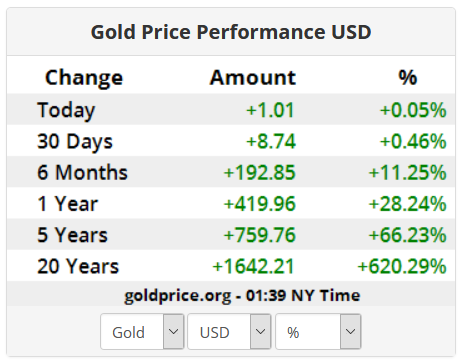

Again, this is also not true. Gold may not be the fastest growing asset class in comparison to some tech stocks, but it has exceeded 600% growth in the past 20 years alone. Gold can’t be printed like the US dollar, it’s resistant to inflation and it’s a reliable store of value.

Preconceived notions aside, none of above-mentioned assumptions actually answered the question posed in the title of this article. The question was: SHOULD you buy gold? Not if you can afford it, not if you need it, and not if its a good investment.

So, if you are ready, lets explore the real topic.

Exploring GOLD

As you ponder over these points related to gold, try to keep an open mind, because you might learn a few things that you never knew about what gold is.

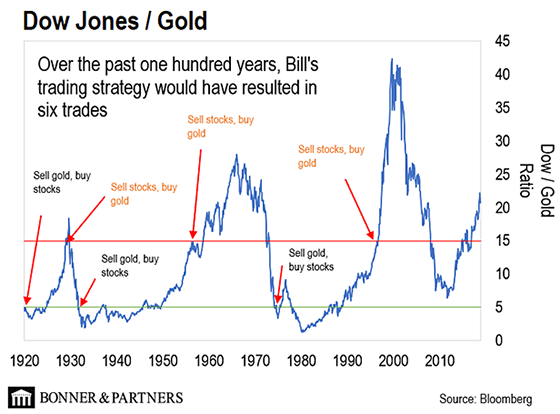

When you buy something that is an investment (like a home or stocks) you expect the value to rise. That way you can eventually sell it with a profit, i.e. capital gains. With gold, this does happen but sometimes it happens very slowly. During those times, the stock market can easily outpace gold. They both seem to go back and forth, like a cycle.

That being said, it would not be wise to buy gold expecting a never-ceasing amount of capital gains from it. What you should expect is for gold to maintain your economic wealth as a store value over time.

So wait—if consistent growth doesn’t always happen with gold, does that mean stocks are just a better choice in general? Not at all.

In 1929 the American stock market was at the height of an immense bubble right before it totally crashed. When that happened, millions of investors got completely wiped out. Of course, no one can predict when and if this might happen again but the lesson is clear: those who had gold were safe. The price of gold went from $20.67 an ounce in 1929 to $35 an ounce in 1934, and it still continues to rise today.

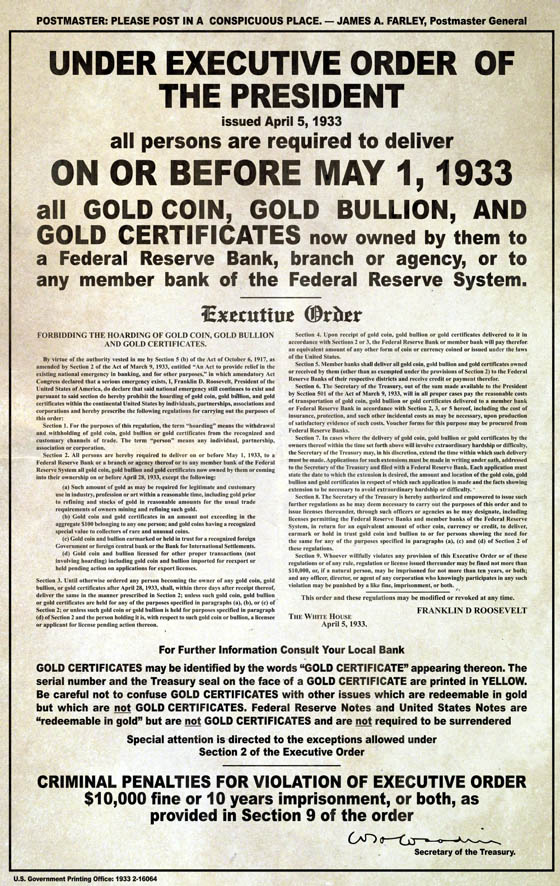

Some may argue that holding gold is less safe than owning stocks or cash since these assets are now digital and can be safely stored in your bank or brokerage. And this fact cannot be denied, looking at history again the US government did at one time make it illegal for citizens to possess their own gold. In 1933 they issued Executive Order 6102. By means of this order the government demanded that all citizens hand over their gold to soften the blow of the great depression.

So Gold can indeed be confiscated or stolen by others who are desperate enough and willing to take what they think you might have. But that doesn’t mean that the exact same thing couldn’t happen to cash sitting in your bank account.

In 2013, the island nation of Cyprus experienced a banking debt crisis. To help pay their enormous bank debts the government decided to bail out the bank by taking the needed money from tax payers savings accounts, and by imposing daily withdrawal limits for everyone. The wealthiest depositors even lost up to 40 percent of their savings in one night. The people protested in the streets, but no one could stop it, it was too late. Their money was gone.

Thinking that this could never happen in your country is being overly optimistic, because anything could happen.

The US dollar is a fiat currency. (Fiat money is a currency established by government regulation, which has zero intrinsic value) If you look at history, every single form of fiat monetary system has eventually collapsed and went to zero.

History also shows that global reserve currency status does not last forever. At some point they all eventually have to leave the stage.

The US dollar has only existed as the world reserve currency since 1944 (when it was established by the Bretton Woods System) and that means it is about 79 years now since it first became a reserve currency. Most don’t last beyond 100 years. Whereas gold has been used to pay for goods since about 700 B.C. (almost 3,000 years ago) and it is still recognized as a store of value in every country on earth even today.

Beyond these facts, some people may still wonder about golds actual intrinsic value:

- What makes gold so valuable anyway?

- Why do people desire to own it?

- Isn’t it just a piece of metal?

- Just a shiny rock?

Well yes, it is those things but it’s also much more.

Gold is a rare, beautiful and precious metal. It can be melted and shaped into jewelry and it has other useful applications too, such as using it for technological components, like circuit boards and microchips. It conducts electricity well and it’s non-magnetic. It’s also biochemically inert, meaning that you can literally eat it (but please don’t) and it will pass through your digestive tract without causing any harm.

Gold is also one of the least reactive chemical elements on earth. It does not combine easily with oxygen, and although it can corrode, it doesn’t decay. It can literally shine forever. This fact alone makes it extremely valuable. But since it’s so rare, its counterpart (silver) is more widely used as an industrial metal.

How gold is made

Almost all the gold on earth was created within the geothermal core of our planet and small amounts eventually were pushed to the surface through volcanic eruptions. Scientists have said that theoretically they could create gold, but it would require a nuclear reaction so no one has managed to accomplish this thus far.

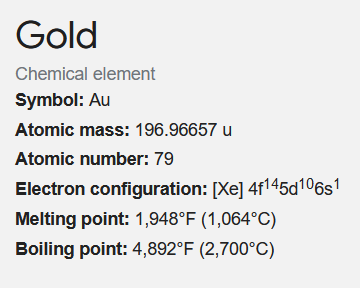

On the periodic table Gold is a chemical element with the symbol Au (from Latin: aurum) and atomic number 79, making it one of the higher atomic number elements that occur naturally. In its purest form, it is a bright, slightly reddish yellow, dense, soft, malleable, and a ductile metal.

So now we know that gold is a scarce, beautiful, rare metal that holds an intrinsic store of value. But perhaps you still feel that you have no reason to own gold? Well, here is more incentive:

Zero counter-party risk

Any time you store your money in a bank or keep your stocks in a brokerage there is always some amount of risk with the third party who is holding your money. The bank could go bankrupt, the brokerage can get hacked, and the stock market could suddenly crash. If any of those things happened, the gold that you own (provided its not kept in a bank) would be totally safe. This is why its recommended to keep your gold well hidden, or even better, keep it in a private vault. The wealthiest people keep their gold in private vaults all around the world. Even powerful governments own gold that they keep in vaults.

This is the reason why president Nixon took the US dollar off the gold standard in 1971. He knew that he had to keep gold reserves in America. If he had allowed gold to continue flowing overseas eventually America wouldn’t have had any wealth left. And this should tell you something: Gold is real money.

TIPS: Everyone should have some money set aside just in case of an unforeseen emergency. If your emergency savings are kept in gold:

1) it’s not so easy to quickly spend it,

2) there is zero counter-party risk, and

3) it is a reliable store of value and could even gain value.

With all of the above statements made, if you are still reading and if you still think you shouldn’t buy gold, please leave a comment. I think it’s wise to own multiple asset classes including physical gold bullion but I’d love to hear an opposing viewpoint.

If you don’t own Gold, you know neither history nor economics.

Ray Dalio

TL;DR Summary

- You might think you cannot afford gold or have no need for gold or its not a good investment, none of these are true.

- Gold can be confiscated or stolen, but the money you have in your bank account is also not completely safe.

- Holding cash? The US dollar is losing value, and all other fiat currencies in history have went to zero.

- You might feel pretty secure with money invested in stocks, but if those companies ever go under, so will your investments.

- Gold is real money. Gold will always have value, but the US dollar won’t.

Additional Resources

- Gold Bugs Vs. Stock Market Bulls

- How much Gold is in a Computer Desktop or Laptop?

- Wikipedia Article on Executive Order 6102

- The Cyprus Crisis Explained (Like You’re an Idiot)

- Investopedia Article: Eight Good Reasons to Own Gold

- The Daily Mail Online News Article: New Cyprus bombshell

- Investopedia Article: When did the U.S. start using paper money?

Disclaimer: This article was written for educational and entertainment purposes only. This is NOT financial advice. Always do your own research and please consult with a licensed attorney before making any serious investment. We are not responsible for any investment decisions that you choose to make.